19 May It Takes A Village To Raise A Black Female-Founded Tech Startup

Geri Stengel

They met on a subway platform in New York City. He admired what she was wearing. She was flattered. He was from out of town. They kept in touch.

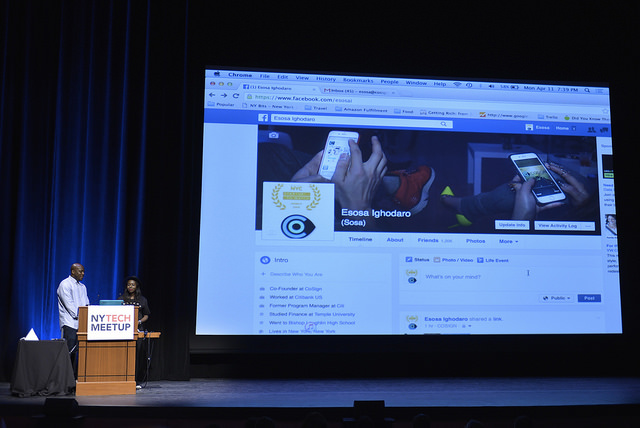

Nope this isn’t a story about a romance. This is a story about a chance encounter between Esosa Ighodaro and Abiodun Johnson that led to a business opportunity. They both had a passion for shopping and technology, and complementary skill sets. Ighodaro is good at operations and marketing. Johnson is a techie.

They founded Cosign, the first mobile app that makes images shoppable on social media. Users are incentivized to tag their new purchases so others can buy them. Cosign earns a commission on purchases it drives to retailers’ websites, which is shared with the user who tagged the image. Approximately 1200 retailers — including Bloomingdale’s, Nordstrom, Macy’s, Kenneth Cole and Saks — are participating. Cosign has more than 13 million products in its database.

You’ve heard me bemoan the funding stats for female-founded companies. Well, it’s much worse for women of color. Black women represent a mere 4% of all women-led tech startups in the U.S., according to #ProjectDiane. Black women represent 18% of all women in the U.S., according to BlackDemographics.com. As important as support from family and friends is, support from consumers, corporations, and professionals (accountants, lawyers, bankers and financial advisors) is even more important for women of color who are starting and growing businesses.

Building the Cosign app took time. Ighodaro and Johnson saved for a year before quitting their jobs. They used their savings to start development. They asked family for funding and were turned down five times. However, things were different on the sixth try. “We showed our families how serious we were about the business,” said Ighodaro. “We always gave them updates on the development of the app. They could see the progress we were making.” Ighodaro and Johnson learned that persistence matters. Their families, like all investors, needed to know how committed they were to the business.

Ighodaro and Johnson needed more money to finish the app. Advisors recommended doing a rewards-based crowdfunding campaign in which backers receive a tangible item rather than shares in a company. You also don’t have to pay interest on the money raised. Frequently, that item is the product you are trying to raise money to produce. Doing a successful crowdfunding campaign is evidence of potential, and makes it easier to raise money from angels, VCs and bankers, and to get retail distribution deals. Read 8 Tips For Crowdfunding Success and Crowdfunding Is A Female Founder’s Best Friend for more about the benefits and best practices.

A Kickstarter campaign raised more than $40,000. Kickstarter backers became the first users of the app, but others found out about it. In total, 5,000 people tried the initial app. Ighodaro and Johnson had the validation they needed. Their app had a market!

Sorry, the comment form is closed at this time.